SOL Price Prediction: How High Will the Solana Rally Go?

#SOL

- Technical Strength: SOL trading above key moving averages with bullish MACD crossover suggests upside potential

- Market Sentiment: Mixed but leaning positive with breakout predictions and institutional developments

- Key Levels: $185 immediate resistance, $202 upper Bollinger Band, $250 as potential longer-term target

SOL Price Prediction

SOL Technical Analysis: Bullish Momentum Building Above Key Moving Averages

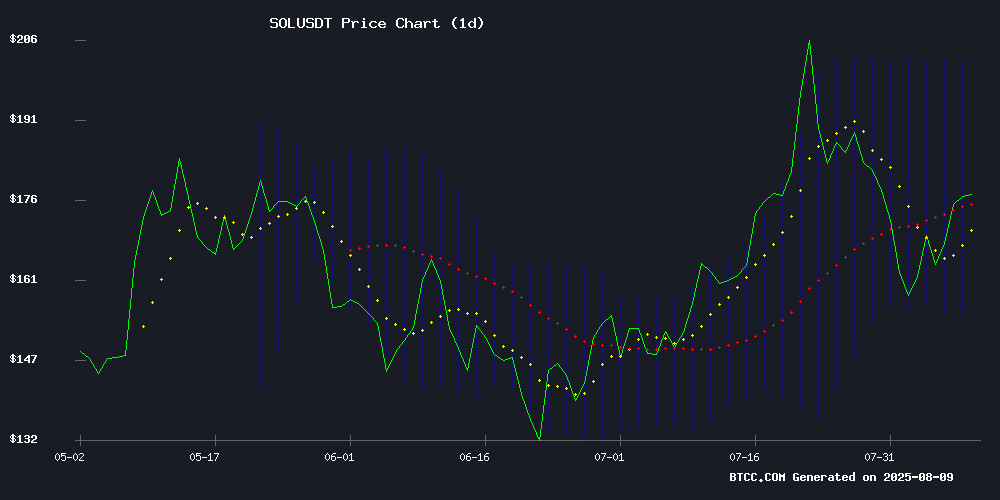

SOL is currently trading at $181.28, comfortably above its 20-day moving average of $178.34, signaling bullish momentum. The MACD histogram shows a positive reading of 6.0040 with both lines in bullish territory (signal line at 3.4832, MACD line at 9.4872). Bollinger Bands indicate potential upside with price hovering NEAR the middle band ($178.34) while upper resistance sits at $201.99.

"The technical setup suggests SOL could test the $200 psychological level soon," said BTCC analyst Mia. "The MACD crossover and price holding above the 20-MA both confirm the bullish trend. Watch for a close above $185 to confirm continuation."

Market Sentiment: SOL Bulls Eye Breakout Amid Mixed Signals

News headlines reflect cautiously optimistic sentiment for SOL, with multiple outlets highlighting potential breakouts above $172 and $250 targets. However, mixed technical signals and the collapsed SPAC deal present some headwinds.

"The $177 support holding is significant," noted BTCC's Mia. "While the failed treasury deal creates short-term uncertainty, the AI trading bot adoption and DeFi developments provide fundamental support. The 7-for-1 stock split news suggests institutional confidence in crypto-related growth."

Factors Influencing SOL's Price

Solana (SOL) Eyes Breakout as Bulls Target $172 Resistance

Solana (SOL) is regaining momentum after bouncing from the $162 support level, with traders now eyeing a decisive break above $172 to confirm bullish momentum. The cryptocurrency has climbed past interim resistance at $165 and $166, trading comfortably above its 100-hour moving average.

Technical indicators suggest growing buyer interest, with SOL surpassing the 50% Fibonacci retracement level of its recent pullback from $172 to $162. Market participants are watching for a potential breakout from a contracting triangle pattern on hourly charts, which could signal the next leg upward.

The $172 level represents a critical technical hurdle, coinciding with both a previous swing high and the 76.4% Fibonacci retracement level. A clean break above this resistance could open the door for extended gains in the near term.

Solana (SOL) Price Holds Above $177 as Technical Indicators Flash Mixed Signals

Solana's SOL trades at $177.41, marking a 1.49% daily gain amid neutral technical indicators. The Relative Strength Index (RSI) at 54.48 suggests balanced momentum, while a bearish MACD divergence introduces uncertainty for traders.

Trading volume remains robust, with Binance spot markets recording $575 million in activity. Price action has been confined to a tight range between $173.88 and $179.66, reflecting consolidation in the absence of major catalysts.

Market participants appear focused on technical factors rather than fundamental developments, as no significant Solana-specific news has emerged in recent sessions. The asset's performance mirrors broader crypto market sentiment rather than chain-specific developments.

Solana Price Prediction: AI Bots Like Snorter Gain Traction Amid SOL Rally

Solana (SOL) has rebounded from a brief correction, trading at $168.89 with bullish technical indicators suggesting a potential doubling in price. Analysts cite a recurring fractal pattern that previously drove SOL from $155 to $265, now eyeing a new all-time high of $340. MACD green histograms and a Golden Cross formation reinforce the optimistic outlook.

Traders are increasingly leveraging AI bots like Snorter to capitalize on meme coin launches within Solana's DeFi ecosystem. The bot's Telegram integration allows rapid response to emerging opportunities, particularly during consolidation phases near the $161 support level. This trend highlights the growing synergy between algorithmic tools and Solana's high-speed blockchain infrastructure.

Solana Price Prediction: SOL Holds Key Support as Breakout Targets $250 in Bullish Setup

Solana's SOL is demonstrating resilience above the $140 support level, with technical indicators suggesting a potential upward trajectory toward $250. The cryptocurrency's ability to maintain higher lows above the 50-day EMA signals growing bullish sentiment among traders.

Market analyst ColdBloodShill notes SOL's well-defined trading range between $140 and $250, with the upper boundary representing a historically significant resistance level. The Relative Strength Index remains neutral, indicating room for momentum buildup if current support holds.

On-chain data reveals increasing buy-side liquidity, reinforcing the positive outlook. A decisive break above $250 could eliminate major supply barriers, potentially catalyzing an extended rally. The $165 level has emerged as an important secondary support zone in SOL's evolving market structure.

Joe McCann-Led Solana Treasury SPAC Deal Collapses Amid Fund Struggles

A planned SPAC merger to take Joe McCann's Solana-focused digital asset treasury (DAT) company public has been terminated, according to sources familiar with the matter. The deal's collapse follows reports that McCann's hedge fund, Asymmetric, has suffered nearly 80% losses this year.

The proposed entity, Accelerate, had aimed to raise up to $1.5 billion through a merger with blank-check company Gores Holdings X. McCann was slated to serve as CEO of the DAT, which sought to capitalize on institutional interest in Solana-based treasury management solutions.

Investors in Asymmetric were recently given the option to exit or roll capital into what appears to be this illiquid DAT venture. The termination underscores the challenges facing crypto-native investment vehicles seeking public market exits amid volatile market conditions.

'Pahalgam' and 'Operation Sindoor' Crypto Tokens Surface Online Amid Security Warnings

New cryptocurrency tokens named 'Pahalgam' and 'Operation Sindoor' have emerged on platforms like the Solana blockchain, raising red flags among security analysts. Both tokens lack essential safeguards: no verified on-chain data, absent audits, and anonymous development teams. Market observers warn these projects may be rug pulls or deceptive schemes targeting uninformed investors.

The tokens' nomenclature adds another layer of concern, with 'Operation Sindoor' directly referencing a sensitive Indian military operation. Such thematic exploitation of geopolitical events often precedes pump-and-dump schemes in the crypto space. The Solana blockchain's association with these tokens highlights the ongoing challenge of policing decentralized networks.

DeFi Development Corp Announces 7-for-1 Stock Split Following Crypto-Driven Surge

DeFi Development Corp., a former real estate software firm now pivoting to crypto investments, will execute a 7-for-1 stock split effective May 20. Shareholders of record as of May 19 will receive six additional shares for each share held, significantly increasing the company's outstanding shares.

The move comes amid a meteoric rise in the company's stock price, which has skyrocketed from under $4 to over $70 in just one month. This rally follows the firm's strategic shift into the Solana ecosystem, including its $58 million SOL holdings and recent acquisition of a validator business.

The split, approved by the board and pending final regulatory steps, underscores how traditional companies are increasingly leveraging crypto assets to drive valuation growth. DeFi Development Corp.'s transformation mirrors broader institutional adoption trends in blockchain infrastructure.

How High Will SOL Price Go?

Based on current technicals and market sentiment, SOL appears poised for further upside with key levels to watch:

| Price Level | Significance |

|---|---|

| $185 | Immediate resistance break would confirm bullish continuation |

| $201.99 | Upper Bollinger Band resistance |

| $250 | Longer-term target mentioned in bullish predictions |

| $177 | Critical support level to maintain bullish structure |

"The $200-202 range is our near-term focus," said BTCC's Mia. "If SOL can break through the upper Bollinger Band with volume, the $250 target becomes plausible in this market cycle. However, traders should monitor Bitcoin's movements as correlated volatility could impact SOL's trajectory."

181.28

178.34